The narrative around accounting tools is often reduced to a crude binary – either you’re on the cloud 100%, or you’re behind the times.

But the fact remains that even after decades of accounting technology innovation, financial data reporting in Excel, armed with a spreadsheet, a few formulas and tried-and-tested processes that you control, is hard to beat.

The challenge for accountants today is how to combine the old and the new in the most efficient and seamless way possible. Here we examine where Excel fits in the modern landscape and how to integrate it into your processes.

Accounts are dealing with a mess of tech

New tools have transformed the way accountants and analysts approach financial management and reporting – often for the better.

Real-time data, automation and streamlined communication have all had a major impact on managing companys’ financial performance, but there is a dark flipside to the wave of innovation.

Many firms now find themselves an unwieldy stack of spot solutions, with too many tools, too many accounts and too little time, slowing down company operations.

This limits the kind of granular financial analysis that helps clients make the informed business decisions around cash flow or planning.

- Automated reporting solutions often don’t fit the needs of clients, resulting in shallow, canned analysis, or extensive manual edits when it comes to preparing financial statements and cash flow statements

- Managing data across multiple business areas and sources between cloud platforms and Excel requires time-consuming manual searching to find the right information

- Firms have to develop bespoke solutions for each client, making it hard to scale forecasting and financial analysis-based services, especially for multiple reporting cycles across the fiscal year

The answer is not to add more tools for more financial reports– no matter what software vendors tell you. It’s much simpler than that.

The real solution has been hiding in plain sight all along – in fact, it never went away.

Research from 2023 found that 63% of American companies consider Excel a vital accounting tool, particularly given its alignment with Financial Accounting Standards Board (FASB) guidelines and Generally Accepted Accounting Principles (GAAP).

Excel is the best tool for financial data reporting

The ugly truth about cloud solutions is that by being built to suit as many businesses as possible, they don’t quite fit any particular one.

There is no ‘average’ SMB, as any accountant who has tried to customize a financial reporting solution knows. Most either lack the necessary features or are too complex for the task they’re designed for.

Excel remains the most effective platform to create and customize financial data reporting on a client by client basis.

Using this familiar and powerful tool enables accountants to prepare financial reports to clients’ exact specifications every time.

What are the advantages of a combined solution over all-in-one?

While there are a range of financial data reporting solutions available that integrate with cloud general ledgers, the reality is that they can seldom match the combined power of a ledger and Excel for managing a company’s financial position and analyzing financial statements.

- No need to train your team on a different tool for every clients – just use the one they know and love

- Saving on multiple software subscriptions for each client

- Deliver clients the accurate financial report they want, not the one the software forces on you

- Get the best of cloud along with the flexibility of excel

That’s why modern accounting isn’t about cloud vs Excel. It should be cloud + excel. The cloud general ledger serves as the central source of truth, with Excel functioning as the workspace for fine-tuned reporting.

The problem is the workflow. Pasting sensitive information between systems is not only risky and prone to error – it’s a major waste of time for paid professionals. Accountants need:

- Live data access from the general ledger without manual transfer

- Integration from multiple sources to create nuanced, holistic financial data reporting

- Secure connectivity to protect client data

That’s where Scott’s add-ins come in.

Creating a connected financial reporting data flow with Scotts

Scott’s Add-ins are designed to connect the solutions that work for you, better.

- Scott’s removes the headache of manual import and export between Excel and your cloud platform.

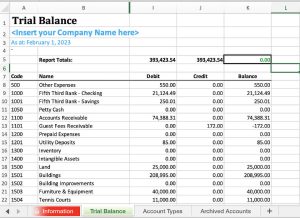

- Accountants can sync live general ledger data from QuickBooks in seconds, with a single click, to build accurate financial reports in minutes.

- With connectivity as standard, you can report and consolidate across multiple QuickBooks entities easily to provide full visibility for clients.

Instant sync not only removes the risk of errors in data transfer, but it also frees up your time to be more creative in crafting your financial reports, so you can deliver a genuinely bespoke service.

This is a game-changer for firms trying to scale the more client-facing and advisory elements of their services, helping teams focus on value provision rather than managing data.

Key reporting benefits we see for firms using Scott’s include:

- Faster reporting: Automatically syncs live ledger data from QuickBooks to Excel, eliminating manual data entry.

- Simple customization: Easily editable Excel templates enable you to meet specific client needs, including adding logos and contact information.

- Efficient calculations: New formulas enable improved data handling efficiency with features like total amount calculations and sorting client payment information.

- Scalable reporting: Facilitates the creation of professional, branded financial outputs such as profit and loss statements, cash flow statements and annual reports, leveraging Excel’s existing functionalities.

Streamline and scale your financial data reporting

Scott’s Add-Ins are the simplest way to simplify your existing accounting technology stack. With our wide range of templates, you can adapt your reporting with a few clicks to deliver bespoke products while still enjoying the benefits of cloud accounting.

- Get started in minutes – no complex onboarding or training required

- Drive more value from your tools without adding new, complex software

- Generate better reports, faster

It’s easy to get started with Scott’s Add-ins – just sign up for a 15-day free trial and start transforming your financial reporting process today.